I got this great idea from "The Total Money Makeover" Forum on Dave Ramsey's website. It's a debt thermometer. This thermometer is 8 ft tall. Every inch represents $1,000 paid off. We decided to put rewards along the way to get the kids involved and encourage us as well. We just stated this year, the red you see is what we paid off in January. I made sure to write that we had already paid off $68,000 though.

I got this great idea from "The Total Money Makeover" Forum on Dave Ramsey's website. It's a debt thermometer. This thermometer is 8 ft tall. Every inch represents $1,000 paid off. We decided to put rewards along the way to get the kids involved and encourage us as well. We just stated this year, the red you see is what we paid off in January. I made sure to write that we had already paid off $68,000 though.

For every $10,000, we get to go out to eat (or something similar) and for every $25,000, we grt to do a mini vacation. The first $10,000 is Olive Garden. Our oldest son has already written the reward on the chart. The second $10,000 will be a trip to the Stone Pizza. The first $25,000 will be a dinner train ride that we have been wanting to take the kids on for a while now. The last day the train runs is September 24th. We should just be able to make it by then.

The kids are really excited about our thermometer and so are we. We will make this leg of the journey a fun one.lovelovelove

lovelovelove

lovelovelove

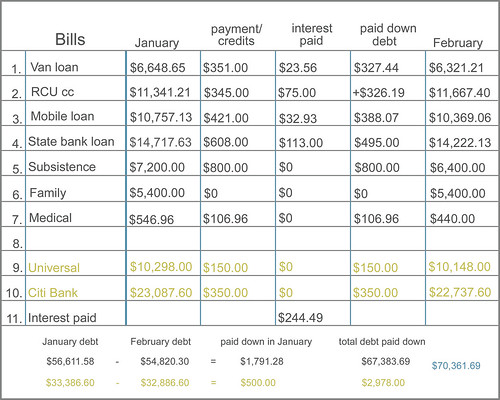

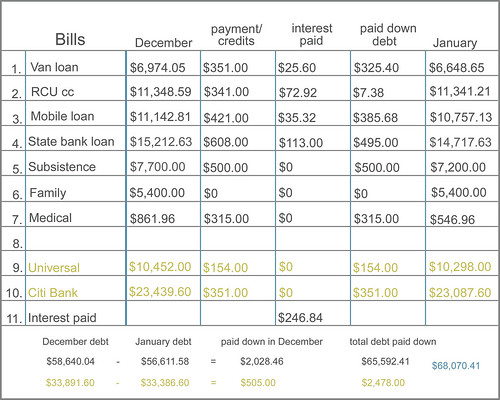

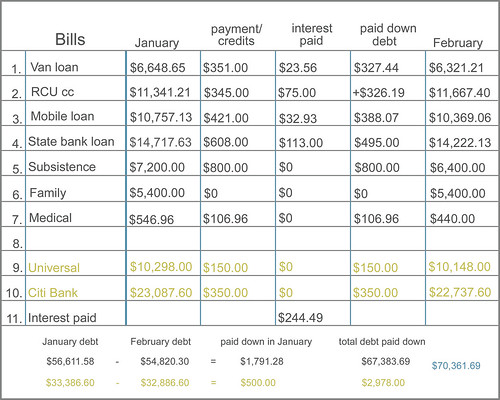

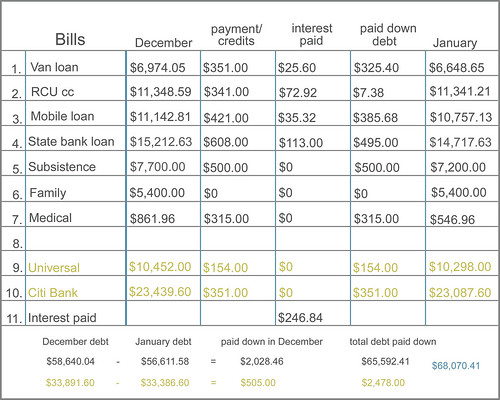

Here is where we stand. I added the two new credit cards to the bottom. I am keeping them separate from the "original" debt just to keep track of everything better. $68,000 is nothing to be ashamed of. We will get there!

Here is where we stand. I added the two new credit cards to the bottom. I am keeping them separate from the "original" debt just to keep track of everything better. $68,000 is nothing to be ashamed of. We will get there!

I just realized that the van loan is much higher on this chart than the last one I posted and thought I should explain. To make a long story short, I took out a bank line of credit this summer when some unexpected things came up. I don't even remember what they were anymore but when I called to ask the bank for $1,000, they offered $5,000 in a Personal Line of Credit. I have no idea why, but I agreed to it and before we knew it, instead of just using the $1,000 we needed, we had used almost $4,000. I called the bank and immediately had the line of credit closed. It was at 8% I believe, so it made more sense to apply the balance to the van loan at a lower rate. In hindsight, I would not have taken out any loan at all and I also would not have lumped it into the van payment. The van was so close to being paid off that it lowered motivation to get it taken care of when the balance almost doubled. Oh well....just another lesson learned I guess.

love

love

love

Hey everyone.

I can't believe it's been almost 6 months since I have posted. The summer and fall were pretty rough. I guess I wasn't feeling much inspiration to get on here. Anyway.....

To sum up what's been going on, we closed on our house Aug 4th. It was the best and worse day. The final amount we needed to bring to closing was just over $35,000. What a great feeling to get the house sold, but what an awful feeling to take on more debt. I know we got rid of the overall mortgage and aren't losing money every month anymore, but it was still a big check to write. Unfortunately, our options were to cash out of the rest of our 401k or to spread the $35,000 over two credit cards. We chose the credit cards. Each would be at 0% for between 14 and 18 months and we are on target to have them both paid off before the interest jumps up.

Other than that, we have just been plugging away, little by little, trying to pay things off. The last two months have been really great. We managed to pay off big chunks, but I am STILL having trouble with the RCU credit card. Why, oh why is it so hard to just get rid of that thing????? I am cutting it up for the last time tonight. (I cut it up once before, but managed to tape it back together)

I was at the Christian Bible Book Store right before Christmas purchasing a few last min children's bible story books. I did not budget these, so I pulled out my taped together credit card and handed it to the cashier. I had just giving an extra coupon to the lady behind me, so we were on "friendly" terms. I kind of laughed at myself when the cashier looked at the card funny. I said it was my attempt not to use it and hoped she wouldn't say anything else. Well, the cashier didn't, but the lady behind me gave me this sympathizing look and asked...Dave Ramsey? I got very excited and said YES! Then I realized how stupid I looked with my cut up and taped back together credit card. It was embarrassing to say the least. I am finally ready to be done with that thing.

We redid our budget and goals for the upcoming year. Dan got his typical 2% cost of living increase so we are going to have that directly taken out of each paycheck and apply it to the subsistence loan. Our medical bills are almost paid off, so we decided to decrease the amount we put into our HSA account and apply the extra from that as well. We had been paying $125 a week towards the subsistence debt and will now be paying $200. That debt should be paid off by October 1st of this year. That will free up another $800 - $1,000 a month to add to the next snowball.

October is also month the first of the two new credit cards from selling the house will jump from 0% interest to about 29%. We are hoping to get back at least enough in our tax return this year to apply $4,000 to that debt. When October roles around, we won't have that bill paid off, but the mobile home will be down by a lot, so we are planning to refinance and use the equity to pay it off. The mobile home loan is at an interest rate of $3.9 and it should stay right around there once we refinance.

We have big plans for this up coming year and some great motivation in place. I will post soon with more on that.

I apologize to anyone who might have wondered why I went. lovelovelove

We had a few things come up this month that drained our emergency fund and then some. New vacuum, new stove, another much needed shed, summer pool pass and family bikes. Some where emergencies and some, admittedly, were not. Either way, we are glad we purchased the things we did. We took out a personal line of credit to pay for a few of these things. That will show up on the July spread sheet. I does bother me that we took out the line of credit. The whole point is NOT to do that anymore. I think we both have been feeling drained by everything. We are going on out 20th month from when we started and I have to say that it is wearing. The money being so tight is frustrating. Most people on this plan are looking at 18 months at the most before being debt free. We still have another 2.5 - 3 years to go. I am okay with a little set back now and again. If buying family bikes keeps us going...then I'm okay with that.lovelovelove

We had a few things come up this month that drained our emergency fund and then some. New vacuum, new stove, another much needed shed, summer pool pass and family bikes. Some where emergencies and some, admittedly, were not. Either way, we are glad we purchased the things we did. We took out a personal line of credit to pay for a few of these things. That will show up on the July spread sheet. I does bother me that we took out the line of credit. The whole point is NOT to do that anymore. I think we both have been feeling drained by everything. We are going on out 20th month from when we started and I have to say that it is wearing. The money being so tight is frustrating. Most people on this plan are looking at 18 months at the most before being debt free. We still have another 2.5 - 3 years to go. I am okay with a little set back now and again. If buying family bikes keeps us going...then I'm okay with that.lovelovelove

We have some very good news, although, it really is bittersweet for us. We received and accepted an offer for $5,500 less than our current asking price just a couple days ago. We are THRILLED to finally be selling, but have to bring a check for $33,000 to the closing table. Our tenants have already signed a new lease somewhere else, so if we did not take it, we would more than likely have to list the house for rent again and go through the hassle, time, expense and headache of trying to find new renters and possibly go a few months without any rent at all. Then we would continue to lose money every month knowing that we will NEVER get that money back. It should take us about 3 years to pay this new loan off. For it to make any sense for us not to sell and take the hit now, our house would have to appreciate more than what we lose on it every year ($8,400). The market is not changing anytime soon. I can't wait to close that chapter of our lives. One more step down!!As much as we hate to do this, we will be taking the money out on a line of credit. We should have 12 - 18 months interest free. When that is up, we will juggle things again, just like we have been doing up until now. Without having it all done yet, I think the payments on that line of credit will be about $900. That is $200 more than the difference between what our monthly payments were and what we received in rent. We will need to re figure things just to make sure it all works out. Our tight budget is going to be about as tight as it can get, but we are so happy knowing we are continuing to pay things off.I will be making a seperate spread sheet for this new debt. I have been keeping our mortgage on the condo off the list of debts up until now and since this is part of that, I want it to be listed seperatly.lovelovelove

As you can see, we are applying more to each the mobile home loan and the van loan, but we are getting a much better interest rate at 3.99% on each of them as well. The condo is still for sale, although our tenants are very uncomfortable living in something that is for sale. They wanted to start looking for a new place. We have had very little interest on the condo at this point, so we didn't want to risk losing them and not selling. We lowered the price of the condo another $4,000 and gave our tenants $300 of their rent for May to let us keep on the market for the next month. If it does not sell, we will take it off and keep our tenants. We are praying that the Lord will send us a buyer but are content knowing that it just might not be in His plan right now. I guess we'll see what happens.

As you can see, we are applying more to each the mobile home loan and the van loan, but we are getting a much better interest rate at 3.99% on each of them as well. The condo is still for sale, although our tenants are very uncomfortable living in something that is for sale. They wanted to start looking for a new place. We have had very little interest on the condo at this point, so we didn't want to risk losing them and not selling. We lowered the price of the condo another $4,000 and gave our tenants $300 of their rent for May to let us keep on the market for the next month. If it does not sell, we will take it off and keep our tenants. We are praying that the Lord will send us a buyer but are content knowing that it just might not be in His plan right now. I guess we'll see what happens.

We will start paying back our subsistence loan at $125 a week starting in July. With that, gas prices going through the roof ($3.98) and all the extra payments we are making on the other loans, our budget is going to get very tight again and will stay that way for at least the next year. The good news is I re figured when we should be out of debt. We are on track to out in just over 2 more years. Sounds like a long time, but we have already been at this for a year and a half so it's really not that bad at all.

Thank you Lord for everything you are providing us!

lovelovelove