It's been a really long time since I last updated. We found out in the beginning of February that we are going to have another baby in October. I haven't felt very well the last couple months, so getting on here to post just didn't really happen. The news of a new baby took some adjustments, but we are very excited to have a newborn around the house again. The kids can't wait.

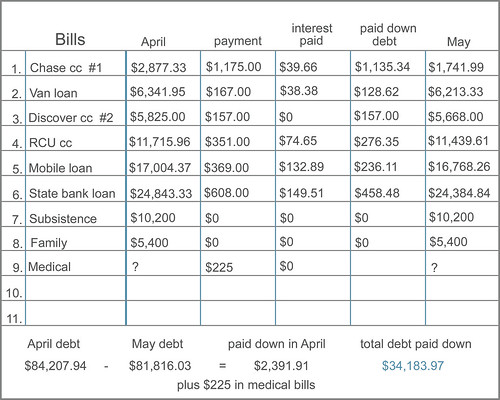

We continue to pay down our debt and every month we get more and more excited to see that there is a light at the end of the tunnel. We would've liked to have the Chase card already paid off by now, but with me being sick the last couple months, I haven't been doing as good of a job with making sure we stay in budget. There was a night here and there that I just didn't have the energy to go to the store for groceries or make dinner, so the kids and I had our fair share of Subway and pizza. That added up. I also did not do any daycare in the month of April. The family that I was working for went through a job layoff. I lost at least $400 of income. I did managed to sell a few more things on craigslist (including a few items for my brother) and I also made $560 selling at the Children's Consignment Sale in April. We used part of that money to buy the kids a swing set and basketball hoop. We figured for $250 it would give the kids plenty of things to do while we play outside and it has been well worth it. They LOVE the swing set. They have been so understanding when we tell them no to things they want to do or buy, so this was something they "earned" and have been looking forward to.

All in all, we have still been doing really well. Nothing is going on credit cards anymore and the overall debt keeps going down. We certainly could be saying no to a few more things, which would help the debt go down even faster, but we both agree that life with our little ones will go faster than we realize and we don't want to look back one day and say we wish we would have done more things with them. So, we have 4 camping trips planned this summer and decided that for each of the kids birthday, they will get to pick an activity (mini golf, bowling, a movie etc.) and we will all go out to eat as a family. These are things we are already starting to budget for.

We are slowly adding back to our emergency fund, which needs to be fully funded again soon. And we have a few house and car repairs that need to be done. We also need a new tent for this summer. Our old one was a 4 man tent. It was a tight squeeze to say the least. It was Dan's from college and had seen many years of camping trips. We would have used it again this year, but the poles finally broke when it snowed during out October camping trip last year. Good memories!!!

Our medical bills are really starting to pile up again. We are spend about $225 -$250 each month on those. I have had a few labs and an ultrasound with this new pregnancy. I forgot how quickly medical bills add up. We will soon hit our $3000 deductible and things should be paid 100% after that.

Our goal is to have the Chase card paid off at the end of this month. Then, on to the van loan!!

love

love

love