Tuesday, March 30, 2010

One more!

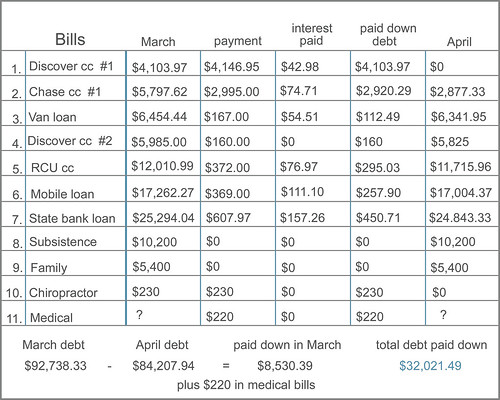

To date, we have paid off Kohl's, Citi Bank and now one of the Discovers. And we are well on our way to paying off the Chase card.

Slowly but surely....we ARE getting there! :)

love

love

love

April

Our $6,600 tax return was more than triple what we expected. We were so excited to take another big chunk out of our debt. We have made tons of progress, but we still have a very long way to go.

We have been at this for about 4 months now and I can already tell it's not nearly as easy as it seems. We have opted out of and passed on so many things to pay down debt. It's a price we are willing to pay, but not an easy one.

We have had to say NO to so many things. Parks and rec programs for the kids, dinner and movie opportunities with friends, sledding with family, birthday parties, family events, shopping trips.....and the list goes on.

I don't want anyone to read this and think it's an easy thing to do. It is taking commitment, dedication and lots of sacrafice to pay down our debt, but we are so glad we are finally doing it!!! The pay off is going to be amazing!

love

love

love

Wednesday, March 10, 2010

the latest update

As I was checking all the credit card balances last month, I noticed that we were charged more interest on the Discover #1 card last month. As it turns out, they raised our interest rate to 23.9%. I called to find out why, but I just got the run around. Nobody would give me a clear answer. They all just kept saying there was nothing they would do about it. I was really upset that day. It's the perfect example of being a slave to your debtors. It's a terrible feeling. There was nothing that we could do but keep working on the debt. They had absolutely NO reason to raise our interest rate, but yet they did and we were just going to have to deal with it. The positive that is coming out of it though, is that we are even more ready to be done with credit cards and credit card companies. They will suck you dry!! I was so mad that day thinking about all the interest they would make off us until we could pay it off that I decided to use the rest of our emergency fund and apply it to the bill.

After spending a few weeks working on the taxes, Dan and I were very excited to find out that we were getting a lot more back than we ever thought we would. Losing so much each month on renting out our house paid off at tax time this year!!

We will be getting $6600 back.

It will be plenty to pay off the Discover #2 card and then we will apply the rest to the Chase #1 card which also has a higher balance of 15.9%. It will still take us another 2 months to completely pay off the Chase, but that will be the last credit card charging us interest. YAY!! It's a really good feeling to being to eliminate all the interest payments we were wasting by our own foolishness.

We were originally going to work on the Discover #2 after the Chase was paid off, but with the extra tax return, we will be a few months ahead of schedule. The Discover #2 is interest free until February 1st of next year, so we will tack advantage of that and work on the van payment next. Before starting on the van though, we will need to rebuild the emergency fund.

love

love

love