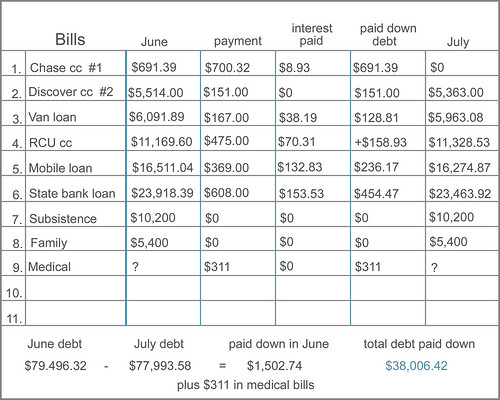

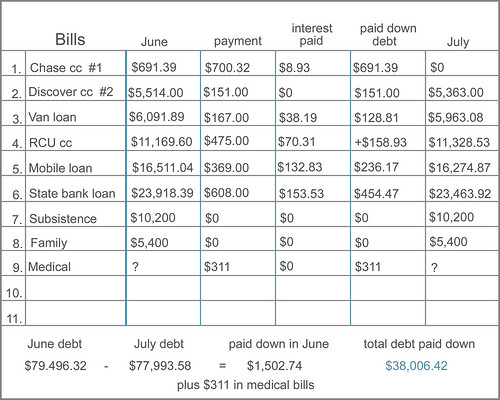

We are one more down!!!I'm not sure how I really feel about this month. We managed to pay off the Chase card, which feels awesome, and we are down another $1,500, but I feel like we should have made more progress. I have been watching extra kids and for LONG hours (7:30-5:30) and have made about $775. This is also one of the 4 months in the year where we have an extra $1150 paycheck from Dan.

We are one more down!!!I'm not sure how I really feel about this month. We managed to pay off the Chase card, which feels awesome, and we are down another $1,500, but I feel like we should have made more progress. I have been watching extra kids and for LONG hours (7:30-5:30) and have made about $775. This is also one of the 4 months in the year where we have an extra $1150 paycheck from Dan.

We talked before the month even started and decided we needed to take care of a few things this month and not put as much towards bills. We agreed to this and we did get a ton of other random things paid for, but I still feel somewhat disappointed.

Here is a list of everything extra we paid for in June.

Dan's contacts - $100

Year book Christmas gift (last years's) for Dan's sister - $60

A much needed slab of cement behind our porch - $250

Over due Culligan bill for our rental - $125

Quarterly water bill - $140

Isaiah's Birthday - $100

Maternity clothes - $150

Camping trips and supplies - $480

License plates renewal - $85

Gas (Dan was not able to give enough plasma to cover it this month) - $150

Rummages Sales - $100

Dan's expense check (instead of Dan using the check book to cover meals (he does get reimbursed) when he is out of town, we planned to just take $100 out and he would keep reusing that instead. Then I don't have to worry about things unexpectedly coming out of the check book. - $100

We managed to pay for a lot of those things with cash, but not everything. A few things ended up going on a CC. That's the part that I am disappointed about. We have not used the CCs for 7 months, until now. I have that pit in my stomach again.

I guess this just means we need to budget better and keep within our means. I will take this as a reminder to STAY ON TRACK!!!!

Next month will get a bit tougher because I had to cut back on daycare hours. The extra money was great, but I don't want a nervous breakdown to get it. This is turning into a tough pregnancy and with 3 1/2 months to go yet, I need to be careful. I should still average about $240 a month, but that is much less then I had been making.

Next month will be a good challenge to see if I can report better numbers.

lovelovelove

Anyone who knows me knows how much I look forward to rummage sale season every year. I start checking the ads in March already. A good portion of our kids clothes and toys come from these sales. I save hundreds, if not thousands, each year. I am not afraid to shop off season or a year or two in advance either. I can't tell you how excited I get when one of the kids need to go up a size and I already have most of the clothes they need stored in a bin. I don't buy junk either. It's name brand, quality items for a fraction of what they cost new. It's one of the BEST ways to save money!!!

I have gotten some really great deals this year already. Just a couple nights ago, I was thinking about getting a 12 inch bike for our soon-to-be 3 year old little girl's birthday coming up. They were between $40 and $50. I stopped at rummage sale and found one in pretty nice condition for $5. Even though it's not new, she can't tell and wouldn't care if she could. I also got a bag full of clothes (6 shirts, 3 shorts, 1 jean, 1 pant, 1 sweatshirt and 2 bunny suits (most people look at me like I am crazy when I call them this, so if you don't already know, they are fleece footy pjs) ALL for $10. The funny thing is I had just come from Kohls looking for for a few bunny suits for camping. They didn't have any because it's only June, so instead of $10 each, I paid .50. Here are some other great deals I have found this year.Maclaren Triumph stroller (retails for $190) - $10Like new Medela double pump, (retails for $285) - $80Baseball shoes for the boys - $1Used twice Easy Bake Oven (I won't say who, but one of the boys REALLY wants one for his birthday) - $1Brand New Fisher Price Zoo Train (retails for $35) - .25Battleship - $2TONS of clothes - .25 - $1 each3 Huge bags of toys (2 Nerf guns, 3 bigger baby toys, transformer helmet, 2 laser tag guns, action figures and a few other dress up items) - $5Scooby and Turtles movies - $1 eachworn only a few times Nike Shox shoes - $2car seat snugli (retails for $45) - $2books - .25 - $1We rarely buy anything for the kids at full price. Some things they get to play with now and some things get set aside for birthdays and Christmas. The great thing about kids is they don't really care about the fancy packaging. And they don't even notice if it's not new. They are just so excited to get something that they like.There is a children's consignment sale twice a year that I have sold at for a few years now. Anything I buy at a rummage sale I can easily resell for the same, double or triple the price that I paid for it. If I regret a purchase or we are done using something, I resell it and I always make back more than what I spent. We just keep recycling!!lovelovelove

I was on a message board just the other day where someone asked what a SAHM can do to bring in extra income. There were a lot of great answers like doing daycare, home party type business or a part-time weekend job, but there was one answer that has really stuck with me. It was not about how to bring in extra but how to manage what was going out. The lady had a great post on how important her job was making sure every single dollar that was spent was used as wisely as possible. As important as it is to work hard and earn a paycheck, it's just as important to make the very best use of that money. She pointed out that shopping around for the best deals, using coupons and shopping the sales and only buying things the family needs will often times equal a bigger savings each month then earning a little extra. Making money is one thing, but managing it is another and both are equally important.

Making money has never been our problem. We both are very willing to work hard. Before getting married, I was working a full-time management retail job and another 20-25 hrs a week at a laundromat. Dan worked 13 out of 14 12 hour days in a factory every summer during college just to pay for rent and living expenses through the school year. Neither one of us is even close to lazy, but we have definately been foolish and very poor managers of the money we make.

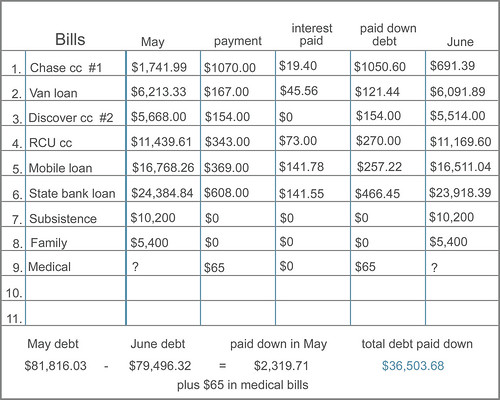

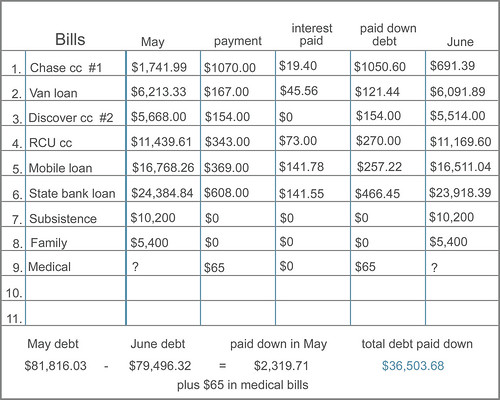

I have been looking over what we made the last 2 months. I was able to make $800 from doing extra daycare in the month of May and if we had stuck to our origional budget, we should have at least another $1,500 paid off by now. It is frustrating, but I find myself saying things like, it was a lot easier to manage our money in the winter because there is so much more to spend money on in the summer. Parties and gathering, weddings, graduations, vaccations, pool pass, summer activities for the kids etc. etc. etc. Needing new maternity clothes has not helped either. We needed to buy a few new things for our camping trips this summer. I felt like we did an okay job of planning ahead and trying to budget it all in, but we went over what we wanted to. I then found myself saying that it was okay because we had done such a great job and have paid off so much at this point. We even ended up putting a small about on a CC. I fell horrible about it. I know it's not the end of the world, but this is how is all starts. Feeling like you deserve it and coming up with reasons for why you "need" to be spending extra. I am so exhausted from watching kids and being pregnant and Dan is working extra hours to make sure he is doing the very best job he can, that it's easy to think we deserve it and that is dangerous territory. Don't get me wrong, I don't think there was anything wrong with spending a little extra on things our family will enjoy over the summer, but I know it was not planned for correctly and that is a BIG problem.

Just like the lady from the messaage board said, managing money and spending it wisely is a full-time job and very important. We do this together as a team, but it is mainly my role right now and I want to do it well. I guess this is why getting out of debt does not, and should not happen over night. It's a learning process and it takes time to change and create new habits or you will find yourself right back where you were. I AM NOT GOING BACK!!!!

Here is what I plan to do in the upcoming months to get focused agian.

Create a new budget plan that includes blow money and budgeted spending money.

Spend more time finding and using coupons and shopping sales.

Start using the envelope system for groceries/diapers/shampoo etc.

Read "The Total Money Makeover" again. I could use the motivation!!HAPPY 5TH BIRTHDAY ISAIAH!! WE LOVE YOU!lovelovelove

The last month or so has been tough. We are having a hard time finding the balance between life right now, knowing it may not be here tomorrow, and applying all our energy to paying off our debt.

We have been seeing our pastor for about a year now, just to help us with typical (and some not so typical) issues we have been going through. At one of our meetings, we laid out our entire financial situation. One question we struggle with is how much to be giving as our offering. Even though we have given more this year than all other years we have been married combined, it's still very small in comparison to what we put out each month on bills and debt. His answer was simple and complicated at the same time. He said we needed to evaluate our heart and pray about it, making sure we were giving for the right reasons and putting God first. He also reminded us that we WOULD eventually get out of debt, but that in the 2 or 3 years it will take us, our offerings could be helping to spread the gosple and save souls.

This process has been about so much more then just math. It's forcing us to evaluate our entire life and to be honest, we are struggling with it. I want to do it all RIGHT NOW. I want to give to church, I want to get out of debt, I want to enjoy life with the kids and I hate having to say no to so many family events. So where do you draw the line? What should your money go to first and how much? These are questions we will continue to pray about and with the Lord guiding us, we will find the right answers. lovelovelove

lovelovelovelovelove

lovelovelovelovelove