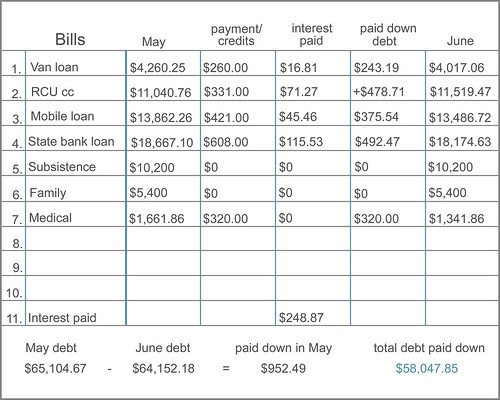

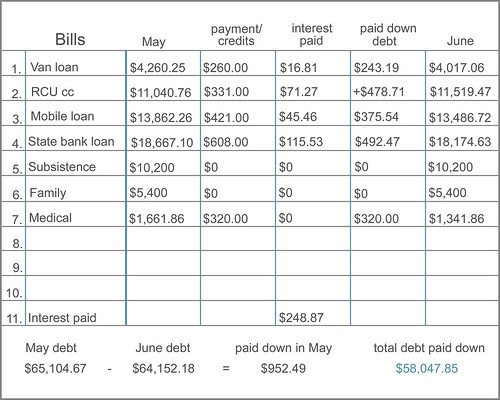

We had a few things come up this month that drained our emergency fund and then some. New vacuum, new stove, another much needed shed, summer pool pass and family bikes. Some where emergencies and some, admittedly, were not. Either way, we are glad we purchased the things we did. We took out a personal line of credit to pay for a few of these things. That will show up on the July spread sheet. I does bother me that we took out the line of credit. The whole point is NOT to do that anymore. I think we both have been feeling drained by everything. We are going on out 20th month from when we started and I have to say that it is wearing. The money being so tight is frustrating. Most people on this plan are looking at 18 months at the most before being debt free. We still have another 2.5 - 3 years to go. I am okay with a little set back now and again. If buying family bikes keeps us going...then I'm okay with that.lovelovelove

We had a few things come up this month that drained our emergency fund and then some. New vacuum, new stove, another much needed shed, summer pool pass and family bikes. Some where emergencies and some, admittedly, were not. Either way, we are glad we purchased the things we did. We took out a personal line of credit to pay for a few of these things. That will show up on the July spread sheet. I does bother me that we took out the line of credit. The whole point is NOT to do that anymore. I think we both have been feeling drained by everything. We are going on out 20th month from when we started and I have to say that it is wearing. The money being so tight is frustrating. Most people on this plan are looking at 18 months at the most before being debt free. We still have another 2.5 - 3 years to go. I am okay with a little set back now and again. If buying family bikes keeps us going...then I'm okay with that.lovelovelove

We have some very good news, although, it really is bittersweet for us. We received and accepted an offer for $5,500 less than our current asking price just a couple days ago. We are THRILLED to finally be selling, but have to bring a check for $33,000 to the closing table. Our tenants have already signed a new lease somewhere else, so if we did not take it, we would more than likely have to list the house for rent again and go through the hassle, time, expense and headache of trying to find new renters and possibly go a few months without any rent at all. Then we would continue to lose money every month knowing that we will NEVER get that money back. It should take us about 3 years to pay this new loan off. For it to make any sense for us not to sell and take the hit now, our house would have to appreciate more than what we lose on it every year ($8,400). The market is not changing anytime soon. I can't wait to close that chapter of our lives. One more step down!!As much as we hate to do this, we will be taking the money out on a line of credit. We should have 12 - 18 months interest free. When that is up, we will juggle things again, just like we have been doing up until now. Without having it all done yet, I think the payments on that line of credit will be about $900. That is $200 more than the difference between what our monthly payments were and what we received in rent. We will need to re figure things just to make sure it all works out. Our tight budget is going to be about as tight as it can get, but we are so happy knowing we are continuing to pay things off.I will be making a seperate spread sheet for this new debt. I have been keeping our mortgage on the condo off the list of debts up until now and since this is part of that, I want it to be listed seperatly.lovelovelove