love

love

love

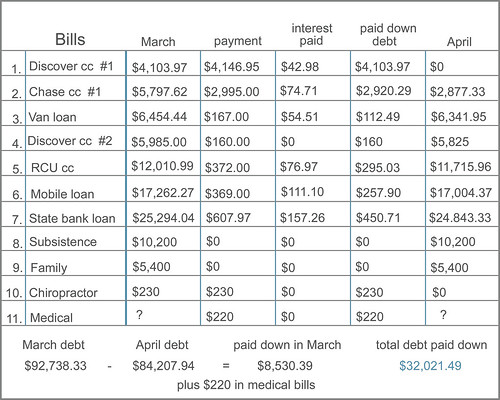

Our $6,600 tax return was more than triple what we expected. We were so excited to take another big chunk out of our debt. We have made tons of progress, but we still have a very long way to go.

We have been at this for about 4 months now and I can already tell it's not nearly as easy as it seems. We have opted out of and passed on so many things to pay down debt. It's a price we are willing to pay, but not an easy one.

We have had to say NO to so many things. Parks and rec programs for the kids, dinner and movie opportunities with friends, sledding with family, birthday parties, family events, shopping trips.....and the list goes on.

I don't want anyone to read this and think it's an easy thing to do. It is taking commitment, dedication and lots of sacrafice to pay down our debt, but we are so glad we are finally doing it!!! The pay off is going to be amazing!

love

love

love

I have a wonderful husband. He truly loves me unconditionally. Sure, he may have faults, but so do I. He is a blessing. He is someone God handpicked for me, because He knows he is what I need. I love him very much. I am looking forward to this journey with him, I look forward to changing our life and our family and growing through this together and no matter what life brings, I look forward to spending the rest of my life with him.

Are you wondering where the extra $200 from the $700 I have saved up is going? We decided to take advantage of the timeshares we own (which we rarely do), and take the kids to a waterpark for 2 nights in February. It will be a VERY cheap mini vacation. It's only a couple hours from where we live. The hotel and water park is included in the timeshare and the $200 is for food or extras that we might need. Our goal will be to spend very little of it and bring home the rest, but we wanted to budget for it in case we needed it. We are all looking forward to a few nights away. We decided it will be easier to stay on track with little mini rewards along the way. Ones that are budgeted for of course.

If you are wondering why we don't just sell our timeshare, we have tried. I had it listed with an agent and even had a buyer last year. The deal feel through and now we are still stuck with it. I guess other people are just smarter about buying these things than we were. ;)

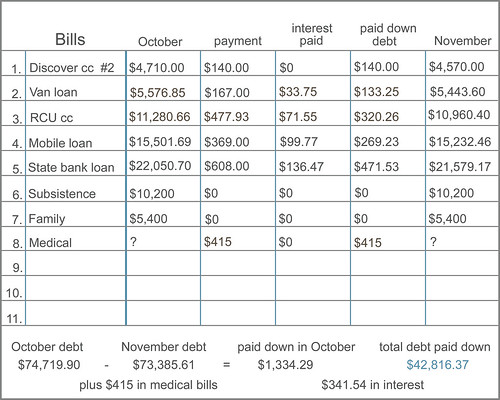

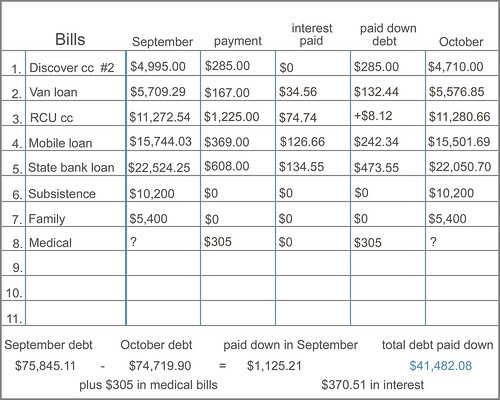

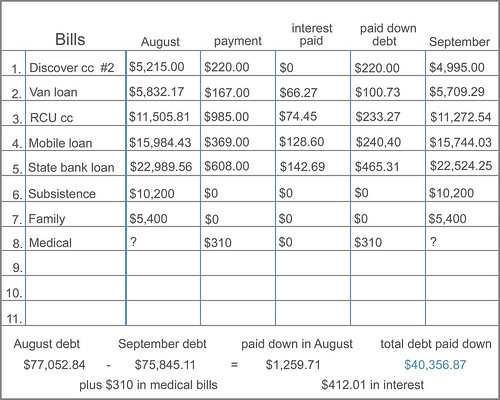

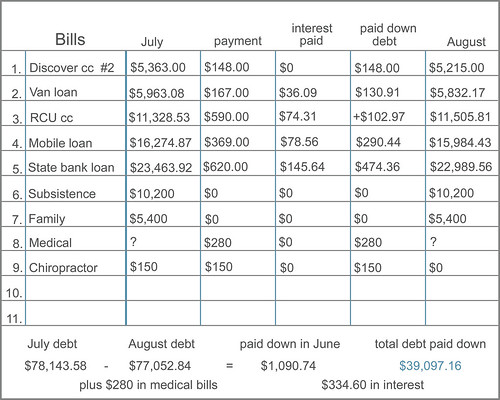

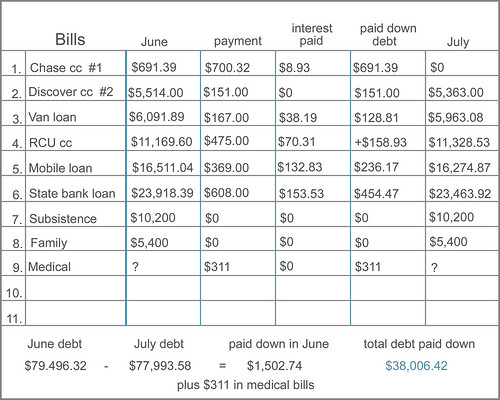

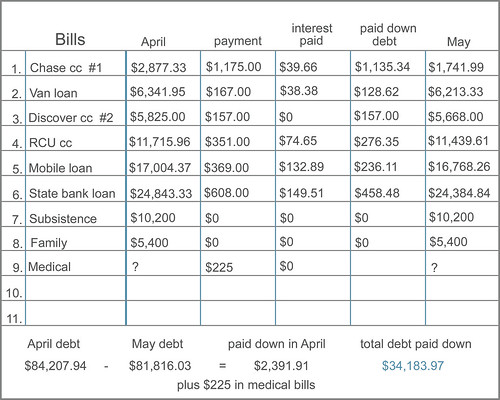

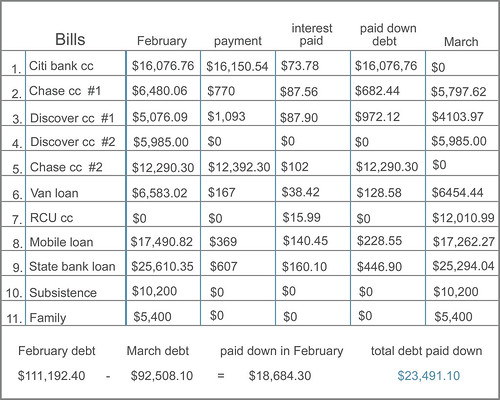

We will list all of our loans and credit card payments each month and the amount we paid on them along with the new balance. It will so rewarding to see them decrease each month.