I was asked to go out for dinner and a movie this weekend with my sister, sister - in - law and a few cousins. Easily a $30 - $40 night. Just not in the budget. Surprisingly, it was not very hard to tell them I could not make it. I really want to deal with this debt and I know what saying yes would do to it.

Dan has been asked a few times if he would be interested in golfing this summer. I know how much he would love to go. Work has been extremely stressful for him lately and he is putting in a ton of extra hours. But again, it would not be helping in the overall goal and in the long run, would not be worth it.

Here is a very good example of why we need to be working together. If one of us said yes, the other might feel resentful. That might turn into even more spending to "get even". I think a lot of couples get caught in this trap. Not only does it cause tremendous marriage issues with trust and anger, but the debt just gets worse. The flip side is a marriage that will strengthen over time. You start to really feel like a team and can not only support each other but be proud of each other as well.

Dan and I are very much looking forward to reaching our goal together, as a team.

love

love

love

Friday, July 30, 2010

Wednesday, July 28, 2010

cutting back some more

I went back and read through the last few months of posts. They were really depressing. Almost every one was about being disappointed and frustrated with ourselves. We decided we need to change that....and quickly. I have felt pretty horrible about the debt and we both have a good deal of regret from our over spending. That just means we have to stop spending.

I had a coupon at a maternity store that ended this past Monday. I could really use another pair of jeans and had been planning on buying another pair, but I have no budget for them. I almost went and got them on the cc, but I didn't, and I feel great about it.

You might remember me saying in a past post that we were going to treat each of the kids to dinner out for their birthdays. Taking a family of 5 out to dinner can easily cost $50 or more. It would not have been a big deal if we hadn't spent all the other money we did this summer. As much as I felt bad about this, it's turning into an even better plan for them. We already took Isaiah out for his birthday and we all got to enjoy that. We decided to take Mykah to the free zoo for a picnic for her birthday and I have a coupon for 2 free lanes of bowling for each of the kids that we are going to use for Jonah's birthday. This way we will get to enjoy 3 different activities as a family. At first, the kids were disappointed, but it did not take long for them to come around. And we were very honest with them about why were changing the plans. We told them we spent too much over the summer and didn't have enough left over. It's another lesson that we can pass on to them. Dan and I are both very hopeful that talking to them openly about what we are going through will benefit them in the future. I think they are learning a lot through us.

This is the start of good posts. I feel really good about this one. It feels SO MUCH BETTER to say no and be disciplined then it does to go over the monthly lack of progress. Nothing we spent money on made it worth it. I hope this means we are leanring good lessons as well.

love

love

love

I had a coupon at a maternity store that ended this past Monday. I could really use another pair of jeans and had been planning on buying another pair, but I have no budget for them. I almost went and got them on the cc, but I didn't, and I feel great about it.

You might remember me saying in a past post that we were going to treat each of the kids to dinner out for their birthdays. Taking a family of 5 out to dinner can easily cost $50 or more. It would not have been a big deal if we hadn't spent all the other money we did this summer. As much as I felt bad about this, it's turning into an even better plan for them. We already took Isaiah out for his birthday and we all got to enjoy that. We decided to take Mykah to the free zoo for a picnic for her birthday and I have a coupon for 2 free lanes of bowling for each of the kids that we are going to use for Jonah's birthday. This way we will get to enjoy 3 different activities as a family. At first, the kids were disappointed, but it did not take long for them to come around. And we were very honest with them about why were changing the plans. We told them we spent too much over the summer and didn't have enough left over. It's another lesson that we can pass on to them. Dan and I are both very hopeful that talking to them openly about what we are going through will benefit them in the future. I think they are learning a lot through us.

This is the start of good posts. I feel really good about this one. It feels SO MUCH BETTER to say no and be disciplined then it does to go over the monthly lack of progress. Nothing we spent money on made it worth it. I hope this means we are leanring good lessons as well.

love

love

love

Tuesday, July 27, 2010

saying no is not easy

No to Ourselves

Our last baby, our little girl, turns 3 in a few days. I wanted a few new baby things when she was born but did not have the money to buy them. I remember telling Dan that I would use what we had but that I really wanted to replace a few things when we had our next baby. So here we are, a couple months away from having our next baby, and I have to decided what to do.

Our bouncy seat is 7 years old and has a tear in it, but it still works. Our bassinet broke after the last baby, so I was always planning to replace that and I would love to get some new crib bedding. I have been looking around at bassinets and bouncy seats for the past few months. I had it narrowed down and even put them in my "shopping cart". They would have cost a little over $200 for both. After seeing how little progress we made on our debt these last few months, I have been feeling really guilty about buying anything. I finally decided I will use our old pack n' play as the bassinet. It's not ideal, but it will work for what we need. I am also going to fix the tear and reuse the bouncy seat. I've become a little attached to it anyway. :) It reminds me of the kids when they were little. And other than a sheet, you really don't need crib bedding. It's more for looks really.

There are still a few things that I would like to get when the baby is born. I always get a new outfit and blanket for coming home from the hospital and even though I have kept most of my baby clothes, there will be a few things I will need to get. I also need to buy a new car seat. I went through all of my baby clothes over the weekend and decided to sell any and everything that I won't need. I also went back through the kids clothes and did the same thing. I usually hang on to stuff like that for "just in case", but I am just storing a lot of it right now. It would be years before I would use some of it anyway. I will put it on the Children's Consignment Sale in September and use the money to buy whatever it is I need for the baby. EMPHASIS ON NEED!! I actually feel relieved making the decision not to buy much. It's just not worth it in the end.

No to Others

We are in charge of planning the family reunion on Dan's dad's side next year. Between gas, extra food and the cost to camp itself, the reunion this year cost us about $400. We certainly love getting together with extended family, but it turned out to be a trip we almost regret. If we would have skipped the 4 camping trips we went on, we would have saved about $1500. That is a lot of money and honestly, we are not sure it was all worth it. It has really made us think about what things we are willing to spend money on in the next year or so.

Between the two of us, we have 4 sides of parents, 16 brothers and sisters, 8 brother and sister in-laws, multiple nieces and nephews, cousins, aunts, uncles and grandparents that we are close with. The opportunities to get together are endless. There is ALWAYS a birthday, graduation, confirmation, holiday, reunion or other event or planned activity going on. We are so blessed and feel so grateful for such a big, loving family, but at the same time, we often feel very torn on what things to attend. Only a few on my side live in the same town as us. Everyone else is 4-6 hours away. Gas is not cheap and the events usually cost money themselves. Even if we only did a couple things with each side of the family, the cost would add up to more then we have right now.

We had a very long talk about what the next year will be like for us. We started out this year saying we would limit ourselves, but still try and do a few things. All that has done is make us feel like we are playing favorites and put us behind on paying off debt. We LOVE our families, but we just can't keep going this way. That is our reality right now.

Every year, we plan a weekend with Dan's family to get together around Christmas. We love it. Everyone looks forward to spending time together around Christ's birthday. We all go to church together, spend the day/weekend together and just have a good time. Between gas, gifts and food, it ends up being a fairly expensive weekend for us. We have been giving a lot thought to this as well.

The problem we are having is being fair spending time with everyone. My sister asked me a while ago why we always seem to prioritize one side of the family over the other. I didn't have a good answer for her. One side is bigger and plans events better than the other, so there are more opportunities with them. She told me it hurts her feelings sometimes and wishes we would spend more time with them. I completely understand her point. We can't say yes to some and not to other's and if we can't do it all, then we have to say no to everyone.

We decided to say no to the reunion next year and will more than likely stay home for Christmas as well. We know this is going to disappoint a lot of people and some will even be mad at us. It's so hard to say no to these things. I know there are people in the family that will say certain things should just be a priority and while I agree with them to some degree, our individual family needs to come first. If the stress of prioritizing extended family is too great on our marriage or on our kids, then we have to say no.

Being a part of some of these extended family events would mean one of two things. We either put off paying down our debt to avoid putting things on a credit card, or we take away the few things that our own family enjoys in exchange. I do not want to tell the boys they can't play t-ball or give up our summer pool pass to be able to make it for Christmas or a reunion. Until we get more debt paid off, it honestly boils down to making those kinds of choices. I know it sounds selfish and that we don't care about other people, but that is not the case at all. We can't wait to be in a position where being a part of everything is something we can enjoy without it causing any kind of stress. That day will come sooner than later if we can make the sacrifices now. Unfortunately, they are not easy sacrafices to make. Although, they shouldn't be. Our debt, mistakes and foolishness have been huge, so the sacrafice has to match.

love

love

love

Our last baby, our little girl, turns 3 in a few days. I wanted a few new baby things when she was born but did not have the money to buy them. I remember telling Dan that I would use what we had but that I really wanted to replace a few things when we had our next baby. So here we are, a couple months away from having our next baby, and I have to decided what to do.

Our bouncy seat is 7 years old and has a tear in it, but it still works. Our bassinet broke after the last baby, so I was always planning to replace that and I would love to get some new crib bedding. I have been looking around at bassinets and bouncy seats for the past few months. I had it narrowed down and even put them in my "shopping cart". They would have cost a little over $200 for both. After seeing how little progress we made on our debt these last few months, I have been feeling really guilty about buying anything. I finally decided I will use our old pack n' play as the bassinet. It's not ideal, but it will work for what we need. I am also going to fix the tear and reuse the bouncy seat. I've become a little attached to it anyway. :) It reminds me of the kids when they were little. And other than a sheet, you really don't need crib bedding. It's more for looks really.

There are still a few things that I would like to get when the baby is born. I always get a new outfit and blanket for coming home from the hospital and even though I have kept most of my baby clothes, there will be a few things I will need to get. I also need to buy a new car seat. I went through all of my baby clothes over the weekend and decided to sell any and everything that I won't need. I also went back through the kids clothes and did the same thing. I usually hang on to stuff like that for "just in case", but I am just storing a lot of it right now. It would be years before I would use some of it anyway. I will put it on the Children's Consignment Sale in September and use the money to buy whatever it is I need for the baby. EMPHASIS ON NEED!! I actually feel relieved making the decision not to buy much. It's just not worth it in the end.

No to Others

We are in charge of planning the family reunion on Dan's dad's side next year. Between gas, extra food and the cost to camp itself, the reunion this year cost us about $400. We certainly love getting together with extended family, but it turned out to be a trip we almost regret. If we would have skipped the 4 camping trips we went on, we would have saved about $1500. That is a lot of money and honestly, we are not sure it was all worth it. It has really made us think about what things we are willing to spend money on in the next year or so.

Between the two of us, we have 4 sides of parents, 16 brothers and sisters, 8 brother and sister in-laws, multiple nieces and nephews, cousins, aunts, uncles and grandparents that we are close with. The opportunities to get together are endless. There is ALWAYS a birthday, graduation, confirmation, holiday, reunion or other event or planned activity going on. We are so blessed and feel so grateful for such a big, loving family, but at the same time, we often feel very torn on what things to attend. Only a few on my side live in the same town as us. Everyone else is 4-6 hours away. Gas is not cheap and the events usually cost money themselves. Even if we only did a couple things with each side of the family, the cost would add up to more then we have right now.

We had a very long talk about what the next year will be like for us. We started out this year saying we would limit ourselves, but still try and do a few things. All that has done is make us feel like we are playing favorites and put us behind on paying off debt. We LOVE our families, but we just can't keep going this way. That is our reality right now.

Every year, we plan a weekend with Dan's family to get together around Christmas. We love it. Everyone looks forward to spending time together around Christ's birthday. We all go to church together, spend the day/weekend together and just have a good time. Between gas, gifts and food, it ends up being a fairly expensive weekend for us. We have been giving a lot thought to this as well.

The problem we are having is being fair spending time with everyone. My sister asked me a while ago why we always seem to prioritize one side of the family over the other. I didn't have a good answer for her. One side is bigger and plans events better than the other, so there are more opportunities with them. She told me it hurts her feelings sometimes and wishes we would spend more time with them. I completely understand her point. We can't say yes to some and not to other's and if we can't do it all, then we have to say no to everyone.

We decided to say no to the reunion next year and will more than likely stay home for Christmas as well. We know this is going to disappoint a lot of people and some will even be mad at us. It's so hard to say no to these things. I know there are people in the family that will say certain things should just be a priority and while I agree with them to some degree, our individual family needs to come first. If the stress of prioritizing extended family is too great on our marriage or on our kids, then we have to say no.

Being a part of some of these extended family events would mean one of two things. We either put off paying down our debt to avoid putting things on a credit card, or we take away the few things that our own family enjoys in exchange. I do not want to tell the boys they can't play t-ball or give up our summer pool pass to be able to make it for Christmas or a reunion. Until we get more debt paid off, it honestly boils down to making those kinds of choices. I know it sounds selfish and that we don't care about other people, but that is not the case at all. We can't wait to be in a position where being a part of everything is something we can enjoy without it causing any kind of stress. That day will come sooner than later if we can make the sacrifices now. Unfortunately, they are not easy sacrafices to make. Although, they shouldn't be. Our debt, mistakes and foolishness have been huge, so the sacrafice has to match.

love

love

love

Monday, July 19, 2010

August

Dan and I sat down last night and talked a lot about the fact that we have been spending more than we should be. We both regret planning too many activities this summer. We have not kept as tight a budget as we did in the beginning and it is really showing.

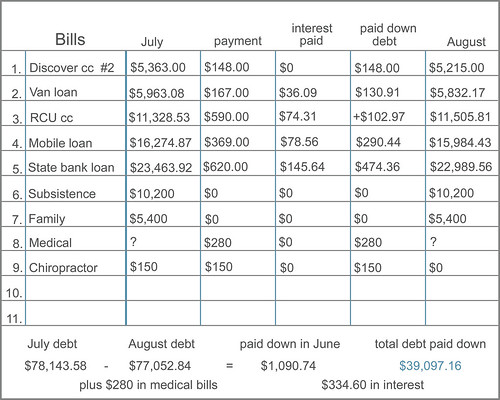

Dan has been listening to "The Total Money Makeover" on CD while driving back and forth to work. I think he is more on board then he even was before and I have definitely had a few reality checks over the last couple months. Keeping track of our bills like this is has been a really good way for us to see what is happening to our debt and is really helping us stay on top of it. We would not have even noticed the $102 increase to the RCU card in the past and then all of a sudden it is not $102 but it's $2,000. We know that scenario all too well.

We both agree that what we need to do a much better job of is planning for things. The new baby is a very good example. There will undoubtedly be expenses that we have not planned for yet. We decided to start a few more savings accounts so we can set money aside for things like Christmas and school events. There is not enough "extra" in checking account to cover everything that comes up, so this seems like our only way to avoid needing to use the CC. I'm pretty sure this was a big part of budgeting that Dave Ramsey talked about, but it just did not hit home the way it should have I guess.

These will be our new saving categories.

Kids (clothes, school events, activities, etc.)

Christmas and Birthdays

Entertainment

House and Car repairs

Not sure how much we will be putting in each one just yet. We hope to put at least $25 - $50 a month in each.

love

love

love

Sunday, July 18, 2010

i think i am going to cry

Up until last month, we have not used a credit card since last November. The debt has been going down and we have felt really good about it. Lately, that is not the case.

We have been doing a fairly good job of budgeting for the things we know are coming up, but we have been unrealistic about what we are able to afford right now and making sure we budget for the unexpected things too. We have used the RCU credit card a few times in the last 2 months with the intent to pay extra on the bill, which we have, but not enough to cover the purchases. I made a payment of almost $600 to that bill this month, but after looking at the statement, it was not enough. A Target purchase here and an ice cream stop there. All the little things add up to a big number at the end of the month. We over planned activities and camping trips with an unrealistic budget for them. I have had to buy some maternity clothes that were not budgeted for, items for the kids and here and there something else has come up that we did not plan for properly. It feels so good to be making progress that we are getting ahead of ourselves with the reality that we STILL have a very large hole to dig ourselves out of. We are not to that place where we can plan extra activities yet. We just aren't. And thinking that I can use the CC and pay extra is just foolish. If we don't have the money at that moment, then we can't buy it. Something IS going to come up between the time I use the card and the day I make a payment that will leave me short....EVERY TIME!!!

I guess this is just another lesson that has to be learned in order to really change how we handle money. Mistakes make you wise, as long as you learn from them. I have a pit in my stomach today. We went backwards on the RCU card again this month. It's a horrible feeling and a humbling experience to say the least.

I had to quit daycare altogether due to this pregnancy, so our income has gone down a lot. Realistically, there just isn't extra money for extra things this year. I have been really torn on how to balance life today and getting out of debt, but if life today and the activities in it are causing stress and a financial burden, then the answer should be very simple. It's hard to say no, not only to ourselves, but to all the friends and family who want us to be a part of things. Those things have cost us too much. We NEED to put all that on hold for while or we will never get our of this financial mess.

love

love

love

We have been doing a fairly good job of budgeting for the things we know are coming up, but we have been unrealistic about what we are able to afford right now and making sure we budget for the unexpected things too. We have used the RCU credit card a few times in the last 2 months with the intent to pay extra on the bill, which we have, but not enough to cover the purchases. I made a payment of almost $600 to that bill this month, but after looking at the statement, it was not enough. A Target purchase here and an ice cream stop there. All the little things add up to a big number at the end of the month. We over planned activities and camping trips with an unrealistic budget for them. I have had to buy some maternity clothes that were not budgeted for, items for the kids and here and there something else has come up that we did not plan for properly. It feels so good to be making progress that we are getting ahead of ourselves with the reality that we STILL have a very large hole to dig ourselves out of. We are not to that place where we can plan extra activities yet. We just aren't. And thinking that I can use the CC and pay extra is just foolish. If we don't have the money at that moment, then we can't buy it. Something IS going to come up between the time I use the card and the day I make a payment that will leave me short....EVERY TIME!!!

I guess this is just another lesson that has to be learned in order to really change how we handle money. Mistakes make you wise, as long as you learn from them. I have a pit in my stomach today. We went backwards on the RCU card again this month. It's a horrible feeling and a humbling experience to say the least.

I had to quit daycare altogether due to this pregnancy, so our income has gone down a lot. Realistically, there just isn't extra money for extra things this year. I have been really torn on how to balance life today and getting out of debt, but if life today and the activities in it are causing stress and a financial burden, then the answer should be very simple. It's hard to say no, not only to ourselves, but to all the friends and family who want us to be a part of things. Those things have cost us too much. We NEED to put all that on hold for while or we will never get our of this financial mess.

love

love

love

Tuesday, July 6, 2010

back on track

I just finished reading "The Total Money Makeover" again. It was very motivational and put me back on track. Dan is not much of a reader. At this point, most of his motivation has come from me telling him what the books say. He has read some things online, but we decided to get him a few Ramsey books on CD. He drives so much as it is that this will not only help pass some time, but would be the perfect way for him to keep motivated as well. The CDs are on sale for $10 through today.

We had a rummage sale over the weekend and made $285. I listed 9 larger items on craigslist today. I hope to sell most of them this week yet. Our storage unit is pretty much cleared out at this point. Not much left to sell. I guess this is what DR (Dave Ramsey) meant when he said to sell everything until the kids think they are next. LOL And you know what, we don't miss anything!! :) I do have a huge pile ready for the next children's consignment sale this September. I hope to make about $600 from that. We will use that money to buy the items we need for our new baby.

We decided we really need to put our emergency fund back. It is making me very nervous not having that "cushion" in case we need it. We already have it back to $250 and hope to have most of the $1000 back by the end of the month. In order to do that, we won't be able to pay any extra on debt this month.

Cutting back on daycare hours means it will take a little longer to pay things off, but we can already tell the trade off is what our family needed right now. This pregnancy is getting harder every day. I was over doing it. I was getting VERY crabby and stressed out. The kids already seem so much happier. And I am too!! No one likes a crabby mom.

This also means we need to be that much more careful with what we spend money on. We decided to cancel a trip to see the Brewers along with a few other smaller things we had on the calender. We also started using the envelope system for groceries last week. I take out what we can spend and that is it. That should help with any over spending.

This month already looks like we will make a great deal of progress!!

Love

Love

Love

We had a rummage sale over the weekend and made $285. I listed 9 larger items on craigslist today. I hope to sell most of them this week yet. Our storage unit is pretty much cleared out at this point. Not much left to sell. I guess this is what DR (Dave Ramsey) meant when he said to sell everything until the kids think they are next. LOL And you know what, we don't miss anything!! :) I do have a huge pile ready for the next children's consignment sale this September. I hope to make about $600 from that. We will use that money to buy the items we need for our new baby.

We decided we really need to put our emergency fund back. It is making me very nervous not having that "cushion" in case we need it. We already have it back to $250 and hope to have most of the $1000 back by the end of the month. In order to do that, we won't be able to pay any extra on debt this month.

Cutting back on daycare hours means it will take a little longer to pay things off, but we can already tell the trade off is what our family needed right now. This pregnancy is getting harder every day. I was over doing it. I was getting VERY crabby and stressed out. The kids already seem so much happier. And I am too!! No one likes a crabby mom.

This also means we need to be that much more careful with what we spend money on. We decided to cancel a trip to see the Brewers along with a few other smaller things we had on the calender. We also started using the envelope system for groceries last week. I take out what we can spend and that is it. That should help with any over spending.

This month already looks like we will make a great deal of progress!!

Love

Love

Love

Subscribe to:

Posts (Atom)