Dan and I sat down last night and talked a lot about the fact that we have been spending more than we should be. We both regret planning too many activities this summer. We have not kept as tight a budget as we did in the beginning and it is really showing.

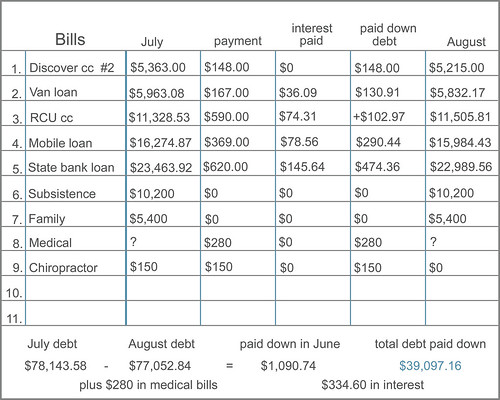

Dan has been listening to "The Total Money Makeover" on CD while driving back and forth to work. I think he is more on board then he even was before and I have definitely had a few reality checks over the last couple months. Keeping track of our bills like this is has been a really good way for us to see what is happening to our debt and is really helping us stay on top of it. We would not have even noticed the $102 increase to the RCU card in the past and then all of a sudden it is not $102 but it's $2,000. We know that scenario all too well.

We both agree that what we need to do a much better job of is planning for things. The new baby is a very good example. There will undoubtedly be expenses that we have not planned for yet. We decided to start a few more savings accounts so we can set money aside for things like Christmas and school events. There is not enough "extra" in checking account to cover everything that comes up, so this seems like our only way to avoid needing to use the CC. I'm pretty sure this was a big part of budgeting that Dave Ramsey talked about, but it just did not hit home the way it should have I guess.

These will be our new saving categories.

Kids (clothes, school events, activities, etc.)

Christmas and Birthdays

Entertainment

House and Car repairs

Not sure how much we will be putting in each one just yet. We hope to put at least $25 - $50 a month in each.

love

love

love

No comments:

Post a Comment